Advocating for Crypto: From Speculation to Empowerment

Written on

Understanding the Essence of Cryptocurrency

Many investors are drawn to the world of cryptocurrency by the allure of wealth. However, those who delve deeper, experiencing the spectrum of the industry—from Bitcoin and alternative coins to decentralized finance (DeFi) and non-fungible tokens (NFTs)—often embark on a remarkable journey of understanding. They come to recognize how:

- Bitcoin distinguishes money from politics, transcending human limitations;

- Smart contracts remove intermediaries and mitigate centralization risks;

- DeFi represents a new, open financial landscape accessible to all;

- Web3 and NFTs facilitate verifiable decentralized ownership.

This progression is common among profit-oriented crypto investors who evolve into informed advocates of the technology. In light of FTX's dramatic downfall, the need for such advocates is more critical than ever.

Advocates in Politics and Business

Political figures, such as Congressman Tom Emmers, have identified the recent challenges faced by the crypto industry as a failure of centralization—failures that the decentralized components of crypto were created to avoid.

Entrepreneurs like Erik Voorhees recognize the transformative potential of an open financial system, which separates money from politics, enabling economic empowerment for individuals.

Cultural figures, such as rapper Snoop Dogg, have long understood how Web3 and NFTs can revolutionize the lives of artists and creators, granting them genuine freedom and control over their work.

In this article, I aim to provide a foundational understanding of what cryptocurrency truly represents and why the world must rally behind it.

Birth of Bitcoin: A Revolutionary Leap

In the aftermath of the Global Financial Crisis (GFC), Satoshi Nakamoto introduced Bitcoin to the world on January 3, 2009. Bitcoin marked a groundbreaking shift in both monetary systems and technology.

From a financial standpoint, the Bitcoin blockchain emerged as an alternative decentralized system that liberates money from government control, enabling finance to surpass human political agendas. This innovation tackled significant issues in traditional finance, including a lack of transparency and the concentration of power among individuals and institutions, which have historically contributed to financial crises.

Bitcoin empowers individuals economically by diminishing the reliance on intermediaries and shielding the vulnerable from centralized control.

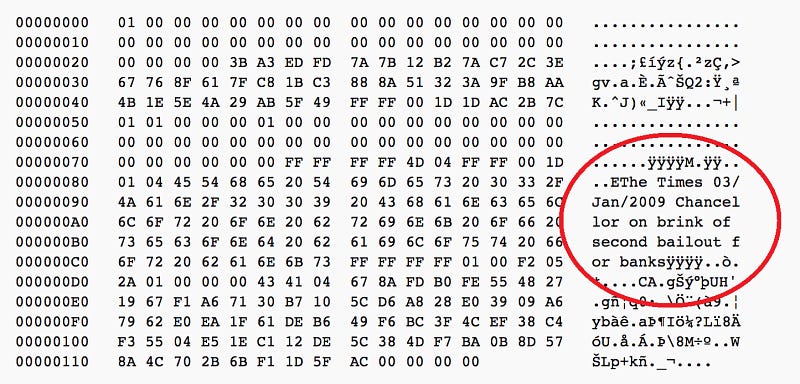

Satoshi mined the initial Bitcoin block, embedding a reference to the GFC: “Chancellor on brink of second bailout.”

From a technological perspective, Bitcoin addressed the challenging issue of achieving consensus across a distributed network of computers worldwide while preventing the notorious double-spend dilemma. Nakamoto achieved this through a pioneering consensus algorithm called proof-of-work, where miners compete to validate transactions by solving complex mathematical problems. Their investment in hardware and energy incentivizes them to secure and uphold the system's integrity.

In essence, Bitcoin resolved the challenge of decentralizing the ownership and operational control of a financial system for its participants.

Milestone in History

Although Bitcoin represented a historic milestone, its complexity made it challenging for many to grasp its significance.

Before the advent of Bitcoin, humanity had never encountered an asset that was simultaneously digital, scarce, and decentralized. While commodities like gold were scarce and somewhat decentralized, fiat currencies were digital but not scarce.

As a digital asset, Bitcoin allows individuals and entire nations to transfer funds across borders without relying on centralized intermediaries like banks.

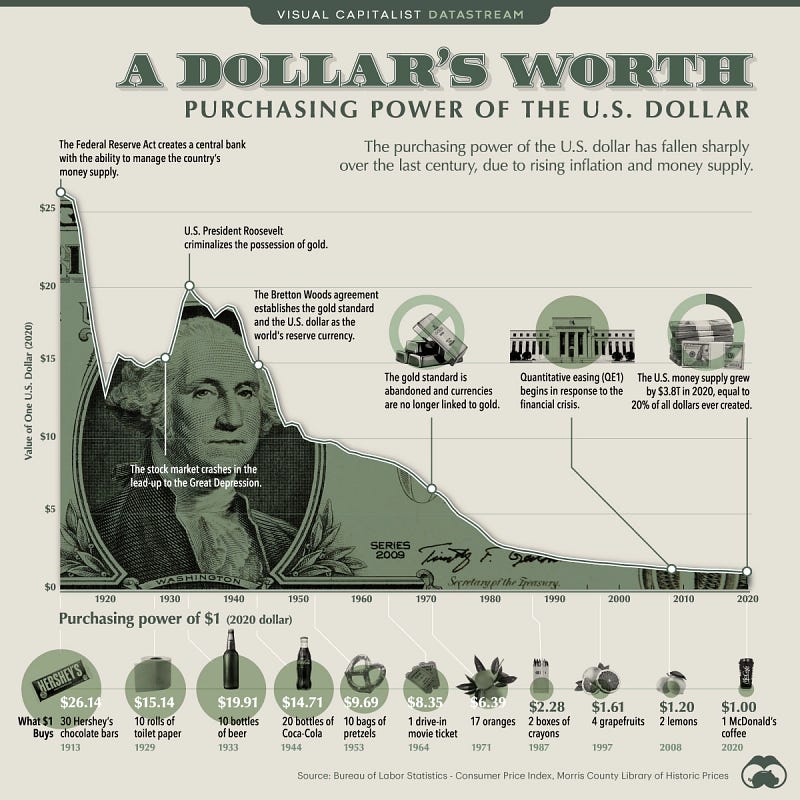

Bitcoin’s scarcity mirrors that of gold, preserving the value of money in contrast to fiat currencies, which can be inflated at will by central banks.

“The root problem with conventional currency is all the trust that’s required to make it work. The central bank must be trusted not to debase the currency, but the history of fiat currencies is full of breaches of that trust.”

— Satoshi Nakamoto

Finally, Bitcoin operates on a public decentralized network, with over 13,000 miners globally contributing to the Bitcoin blockchain. This structure safeguards against single points of failure, as the network isn't controlled by any individual or organization.

No Gatekeepers and No Middlemen

Let’s explore the ramifications of having a public decentralized network—it's revolutionary.

In blockchain terminology, "public" equates to "permissionless" and "trustless." Anyone can join the network without gatekeepers. In traditional finance, my ability to open a bank account or send money hinges on government and financial intermediaries' permissions, which can exclude individuals arbitrarily.

Many individuals from sanctioned countries, like Iran and North Korea, face barriers that strip them of their economic agency, which many view as unjust regulatory overreach.

Under the Bitcoin network, there are no gatekeepers; it’s an open decentralized system resistant to censorship. You and I can participate anytime, provided we have an internet connection and a Web3 wallet—no permissions required.

"Trustless" means that consensus can be achieved without relying on third parties or central authorities. This eliminates the need for intermediaries; transactions between individuals occur directly, without requiring a bank's involvement.

The impact of these principles was magnified six years after Bitcoin's launch with the introduction of smart contracts, which sparked the rise of a decentralized global financial system (DeFi), enabling the exchange of various virtual goods and services without middlemen.

Smart Contracts, Web3 & NFTs

In 2015, Ethereum launched, introducing smart contracts that enabled general-purpose computing on blockchains, earning Ethereum the title of decentralized "world computer."

Smart contracts are immutable, ensuring they cannot be altered once deployed, making them resistant to tampering. This allows for complex peer-to-peer transactions without needing centralized authorities or the mutual trust of parties involved.

Smart contracts eliminate the need for unreliable intermediaries in transactions. This innovation expanded the benefits of Bitcoin's decentralization to a broad array of applications.

Web3: A Decentralized Future

Web3 represents the next evolution of the internet, built on:

- Blockchain technology for decentralized web infrastructure;

- NFTs for data, asset, and identity ownership;

- Smart contracts for automating transactions without intermediaries.

The Web 2.0 era has been dominated by major tech companies that centralized control and profited from user data. In contrast, Web 3.0 seeks to return to a decentralized model reminiscent of the early internet.

You will interact with decentralized applications (dApps) that run on the blockchain, utilizing both fungible assets (like BTC and ETH) and non-fungible tokens stored in your Web3 wallet (such as MetaMask).

These interactions occur without centralized entities, as smart contracts execute transactions on the blockchain. For example, swapping USDC for ETH can be done on a decentralized exchange (DEX) like Uniswap without any custodians involved.

Web3 profoundly alters our relationships with conventional power structures:

- Decentralized Financial Control: Traditional finance and banks become obsolete. We gain autonomy over our financial transactions, facilitating peer-to-peer exchanges globally without intermediaries.

- Fair Compensation for Creatives: Artists and creators receive equitable compensation through royalties embedded in smart contracts, which execute automatically with every engagement with their work.

- User Control Over Data: In a Web3 version of social media, users might receive dividends from ad revenue or sell their data as NFTs in decentralized marketplaces. Our digital identities can be portable, crossing different platforms seamlessly.

As Web3 strategist Julie Plavnik emphasizes, the crypto revolution has instigated a shift towards disintermediation and self-sovereignty, prompting us to rethink our relationship with technology.

Final Thoughts: Embracing the Decentralized Future

The capacity to decentralize rule enforcement only emerged with blockchain technology. Initially, Bitcoin provided a new, transparent, and inclusive financial system in response to the GFC, prioritizing decentralization and transparency.

Subsequently, modern blockchains like Ethereum and Solana have propelled the development of vibrant DeFi, Web3, and NFT ecosystems.

Erik Voorhees has described DeFi as the "shining city on the hill," representing the beauty of crypto—an open, immutable economic foundation for everyone.

In late October 2022, Voorhees passionately urged Sam Bankman-Fried to protect DeFi, recognizing the potential for a financial system that serves all humanity.

Ironically, shortly after this discussion, FTX's collapse underscored the risks of centralization. As the blockchain space continues to innovate rapidly, the world is transitioning to Web3, moving from centralized servers to decentralized blockchains and from traditional banking systems to crypto wallets.

Cryptocurrencies are vital for this evolving decentralized future, acting as the lubricant for the blockchains, dApps, and smart contracts that will define the next generation of the internet.

I hope this article encourages you to advocate for cryptocurrency and blockchain technology—not merely as investment vehicles but as foundational technologies for future generations.