Navigating Financial Choices on My Journey to FIRE

Written on

Chapter 1: Introduction to My Financial Journey

Welcome to my second weekly financial overview as I pursue Financial Independence, Retire Early (FIRE). In my previous update, I laid the groundwork by detailing the total amount in my various savings and spending accounts. While I wish my progress could be faster, I am currently focused on maximizing my savings as I work towards completing my master's degree in January. For more information on this, feel free to check out my earlier article.

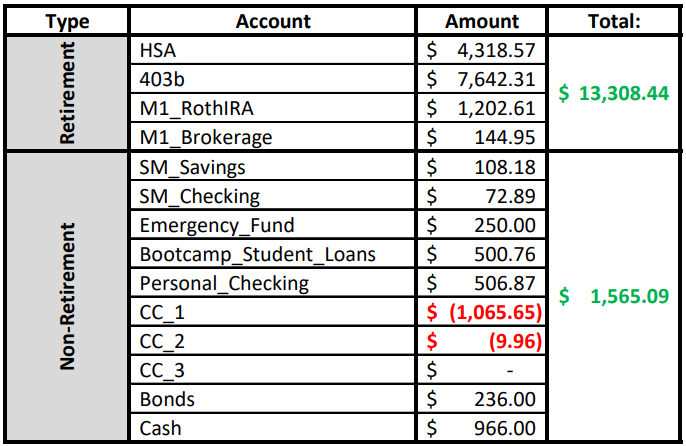

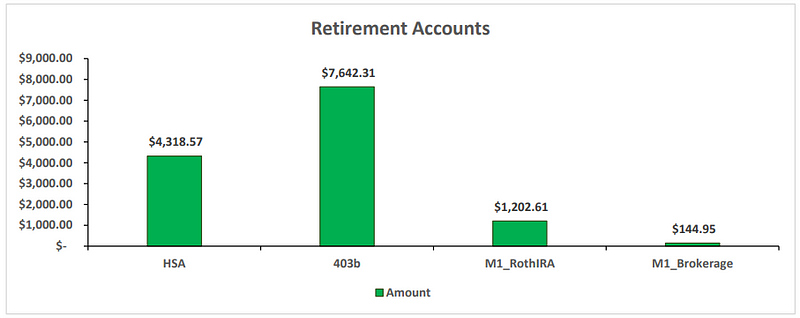

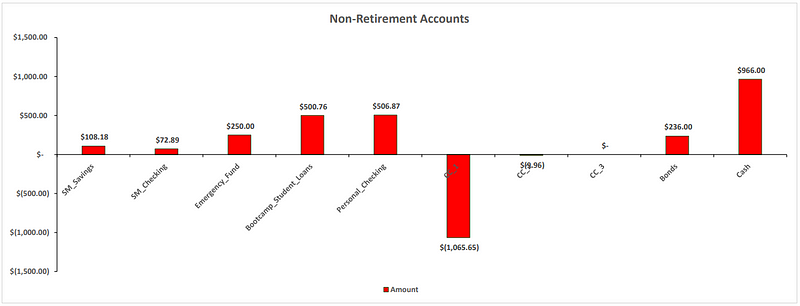

Below, you will find a summary of my account balances along with visual representations of my retirement and non-retirement account groups. Additionally, I will provide insights into my personal expenditures from the past week.

Chapter 1.1: Account Balances and Visualizations

In the table below, you can see my account balances, excluding student loans, which I discussed in the introduction.

As you might observe, I haven’t had the chance to visit the bank to deposit cash or settle my credit card bill. Unfortunately, I was unwell this past week, which limited my mobility and kept me from exposing others to my illness. I plan to visit an ATM soon to address these transactions. The recent credit card balance reflects my purchase of Covid tests, which I partially paid for using points. I managed to pay that off while drafting this article, but the update will only show in my account by Monday.

What Did I Spend Money On This Week?

Being under the weather can often lead to impulsive spending, as I tend to browse online for items that might lift my spirits or enhance my hobbies. However, I can report that I didn’t indulge much this week—until today. I did spend some time browsing websites related to my favorite hobby, which I aspire to turn into a business someday. Realistically, I already have more supplies than I need, so purchasing more would be impractical. I managed to close all the tabs without making any purchases, although I may consider allocating some guilt-free spending for these items in the upcoming months.

In full transparency, I did spend $2 on a MegaMillions ticket while out with my spouse, which is why my cash balance shows a decrease of that amount compared to last week. I maintain a casual attitude towards lottery tickets but believe it’s crucial to track my spending on them to understand where my money goes. Typically, I wait until the jackpots for MegaMillions or Powerball hit $300 million to limit my spending. I plan to adhere to this rule before purchasing another ticket.

In summary, my total expenditures this week amounted to $9.96 for Covid tests and $2 for the lottery ticket—nothing beyond that.

Chapter 1.2: Anticipating Next Week's Financial Landscape

Yesterday marked payday, which is reflected in my current account balances. I also received $250 in work reimbursements, contributing to a higher checking account balance. Furthermore, a $15 rebate from Rakuten helped bolster my funds. As we approach the beginning of November, I anticipate a withdrawal of $478 from my bootcamp savings account, along with a $25 transfer from my regular checking to my SM savings/checking accounts. My student loan payment is due on the 16th, so that won’t require my attention until after the next paycheck.

Did I stick to my goal of not spending money this past week? Unfortunately, no. However, I consider the Covid tests necessary, and the $2 spent on the lottery ticket feels justified since I haven't treated myself to coffee and likely won’t until my next paycheck. Let’s see if I can refrain from any additional spending outside of necessary bills next week!

Chapter 2: Insights from Financial Roundup Videos

In this video, titled "Taking the Fear Out of Your Future," the speaker discusses practical strategies to manage financial uncertainty and plan for a secure future.

The "Financial Roundup" video offers additional insights into effective financial management, helping viewers navigate their financial journeys with confidence.