Navigating the High-Speed World of High Frequency Trading

Written on

Chapter 1: The Evolution of Trading

The financial landscape often appears stable and conservative. Yet, every decade, groundbreaking innovations emerge, transforming how we understand finance—think of blockchain and cryptocurrencies, which are currently reshaping banking and investment sectors.

One pivotal advancement that revolutionized retail investing was the introduction of index funds. In 1976, John Bogle launched the Vanguard 500 Fund, the first index fund aimed at individual investors, enabling them to gain exposure to the S&P 500 effortlessly.

Conversely, another development—High Frequency Trading (HFT)—has largely flown under the radar, often to the detriment of retail investors. This trading method, which has gained momentum since a 2009 New York Times article highlighted its implications, now constitutes a significant portion of trading volume on major exchanges like the NYSE.

A detailed overview of High Frequency Trading, focusing on its mechanics and implications for retail investors.

What is HFT?

High Frequency Trading, as the name implies, utilizes computer algorithms to execute thousands of trades within fractions of a second, measured in milliseconds or even microseconds. For context, a microsecond equals one-millionth of a second. HFT is characterized by complex algorithms, co-location, and extremely short investment timelines. According to the SEC, HFT involves “professional traders acting in a proprietary capacity that engage in strategies generating numerous trades daily.”

A specialized team of quantitative analysts, often PhDs and computer scientists, designs proprietary trading algorithms that exploit market inefficiencies. For instance, an HFT algorithm can obtain stock quotes marginally faster than the public, allowing it to buy shares at $100 and sell them to a retail investor at $101. When executed millions of times in microseconds, these trades yield substantial profits. HFT strategies include arbitrage—purchasing low on one exchange and selling high on another—as well as various other methods, some of which may be considered less ethical, such as quote stuffing.

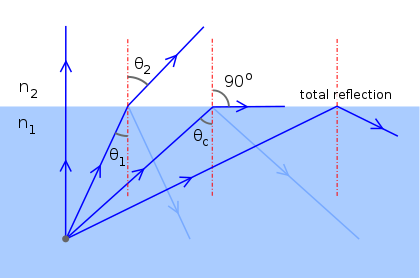

The speed of these trades relies heavily on the proximity of HFT terminals to stock exchange servers. The shorter the distance, the lower the latency, which enhances trade execution speed. To achieve this, traders invest in specialized hardware and may even opt for microwave connections over traditional fiber optics to further reduce delays.

A Brief History of HFT

High Frequency Trading can trace its roots back to the 1930s, when traders utilized telegraphic systems to communicate with various exchanges. The introduction of computerized order flows in the 1970s marked a significant shift, culminating in the NASDAQ's launch of the first automated exchange in 1983.

Donald Mackenzie, in his book Trading at The Speed of Light, discusses HFT's formal inception at a firm named Island, which was established in 1988. Island's electronic matching system facilitated quicker trades, prompting other firms to relocate their servers closer to its operations.

Today, HFT is dominated by a range of firms, including well-known names like Citadel, LLC, and Virtu Financial. Interestingly, online brokerage platforms like Robinhood generate substantial revenue by routing client orders to these market makers.

A visual exploration of High Frequency Trading's history and its key players in the market.

Current Landscape and Controversies

As of late 2020, HFT accounted for approximately 50% of trading volume in US equity markets, a figure that may have increased since then. The data needed to accurately assess HFT's impact on various exchanges is limited, making it challenging to quantify.

While proponents argue that HFT enhances market liquidity and price discovery, critics highlight its inherent risks. The infamous flash crash of May 6, 2010, which caused a rapid decline in the stock market, is often attributed to HFT practices. Techniques like quote stuffing can lead to market manipulation, leaving retail investors confused and vulnerable.

The potential for systemic risk is a significant concern, as disruptions in one market can have cascading effects on others. Consequently, HFT embodies a double-edged sword—capable of improving market efficiency while posing risks to everyday investors.

The Future of Investing

HFT serves as a warning about the importance of understanding technology in finance. Retail investors now have access to robo-advisors that tailor investment strategies to their goals, leveling the playing field against institutional investors. However, wealth is increasingly concentrated among those who can effectively harness these technologies.

The rapid evolution of financial technologies demands that we prioritize learning over passive consumption of media. Understanding innovations like blockchain could have empowered investors to capitalize on cryptocurrency trends before they became mainstream.

To stay relevant in this fast-paced world, we must shift our focus from "processed" content to engaging with the exponential technologies that are redefining our financial landscape.

Additional References

For those wishing to delve deeper into HFT, consider the following titles:

- Trading at The Speed of Light by Donald Mackenzie

- Inside the Black Box: A Simple Guide to Quantitative and High-Frequency Trading by Rishi K. Narang

- Flash Boys: A Wall Street Revolt by Michael Lewis

- Broken Markets: How High Frequency Trading and Predatory Practices on Wall Street Are Destroying Investor Confidence and Your Portfolio by Sal Arnuk and Joseph Saluzzi

- High-Frequency Trading: A Practical Guide to Algorithmic Strategies and Trading Systems by Irene Aldridge

For a more cinematic insight, The Hummingbird Project offers a compelling narrative on HFT and algorithmic trading.