The Timely Emergence of Bitcoin in Economic Turmoil

Written on

Chapter 1: The Historical Context of Bitcoin

Bitcoin was introduced at a pivotal moment in history, as global events pushed investors to seek more reliable forms of currency.

On October 31, 2008, Satoshi Nakamoto published the Bitcoin whitepaper. Interestingly, this date coincided with Halloween—a day that might inspire some light-hearted celebrations for Bitcoin's 14th anniversary. But what else was happening in the fall of 2008?

The Philadelphia Phillies clinched the World Series title against the Tampa Bay Rays on October 29, 2008, while my New York Giants triumphed over the Pittsburgh Steelers just days earlier, on October 26, 2008. However, the more pressing issue was the United States government allocating a significant portion of a $700 billion bailout to rescue faltering banks, largely due to their risky involvement with sub-prime mortgages.

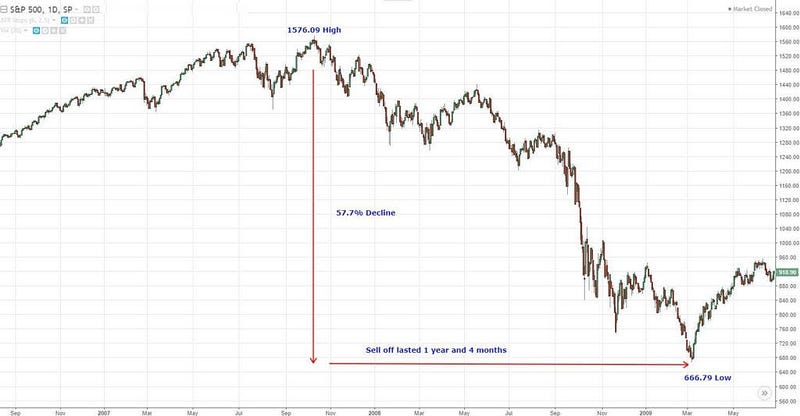

By October 27, 2008, the Dow Jones Industrial Average had plummeted from a peak of 14,093 to 9,325, marking a staggering 33.8% decline over the year. In the subsequent months, this index would hit a low of 6,626, clearly illustrating the bear market conditions at the time.

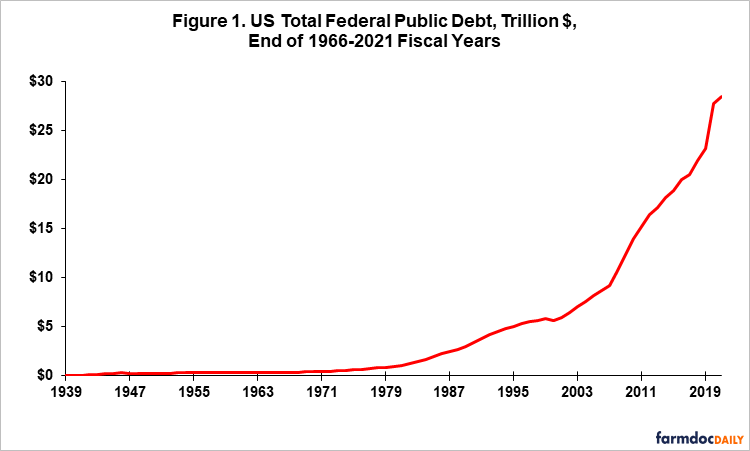

The Great Recession was in full swing globally. Although Bitcoin had just been launched, it had yet to capture the world's attention. The national debt of the United States was also set to skyrocket, driven by the necessity to bail out banks and inject liquidity into the economy. While opinions on this "necessity" varied, the outcome was undeniable.

From 2008 to 2017, the U.S. national debt surged from $10 trillion to $20 trillion—an extraordinary growth that established a new record for any nation. The year 2020 brought the COVID-19 pandemic, which led to unprecedented money printing in the U.S. and trillions more added to the national debt.

Amidst this tumultuous backdrop, Bitcoin began to gain traction. It seemed as though Satoshi had foreseen a future characterized by easy credit, an expanding money supply, and rampant government expenditure. With a fixed supply, Bitcoin presented an alternative that many savers and investors considered as a refuge for their dwindling assets.

The Shift Towards Harder Currency

Currently, around 80% of the U.S. currency in circulation was generated in just the last two and a half years. This staggering rate of money creation is clearly unsustainable.

The repercussions? A wave of inflation that has not been witnessed in four decades. The purchasing power of the U.S. dollar, along with other currencies, is rapidly diminishing, contributing to two consecutive quarters of negative GDP growth—indicating a recession.

Bitcoin emerges as a potential solution—a currency, a store of value, and a savings alternative that allows investors to exit the fiat financial system, which is largely governed by unelected central bankers responsible for endless money printing, persistent inflation, and disruptive economic cycles.

Interestingly, Ben Bernanke, the Federal Reserve chair who facilitated nearly zero interest rates and the easy credit that triggered the Great Recession, was recently awarded the Nobel Prize in Economics. This recognition has left many feeling disillusioned.

Cory Klippsten articulated the potential of a Bitcoin standard over a fiat standard in his newsletter, The Daily Bitcoiner, stating: “Bitcoin signifies a return to rational economic principles, contrasting sharply with the ‘money grows on trees’ mentality adopted by central banks globally.” Cory Klippsten, October 10, 2022.

Well expressed, Cory.

Subscribe on Substack — Always Free!

Chapter 2: The Role of Bitcoin in Today's Economy

As Bitcoin continues to capture the imagination of investors, it represents more than just a cryptocurrency; it symbolizes hope for a more stable financial future.

In this video titled "BITCOIN: NEVER BEFORE in Crypto History Has This Happened! (Don't FK This Up!)", explore the unprecedented events shaping Bitcoin's trajectory and the implications for the future of cryptocurrency.

The second video, "BITCOIN HISTORY REPEATING (Prepare Now)!! Bitcoin News Today & Ethereum Price Prediction!", offers insights into current trends and predictions in the cryptocurrency market.